VIX Spikes as Nvidia Rally Fades: What's Driving Volatility and Market Fears

Nvidia's Mirage: The VIX Whispers a Different Story

Nvidia's earnings were supposed to be the shot in the arm the market needed, a validation of AI's seemingly endless potential. The initial surge confirmed that narrative. But the swift reversal, with Nvidia erasing intraday gains, tells a different story. The S&P 500, Dow, and Nasdaq all followed suit, proving that even the shiniest object can't distract from underlying anxieties.

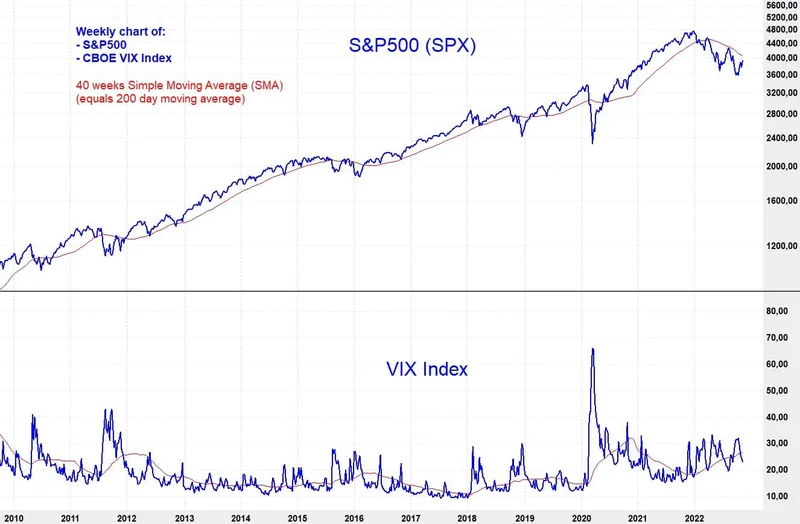

The Cboe Volatility Index ($VIX) is the real canary in the coal mine, spiking 19% to its highest level since mid-October. That's not just a blip; it's a primal scream of uncertainty. While talking heads on VIX TV might point to the usual suspects – inflation, interest rates, geopolitical tensions – the truth is often simpler: the market is scared. The VIX isn’t just “rich”; it's reflecting a deeper unease that Nvidia's earnings, however impressive, couldn't mask.

Labor Market Paradox

The economic data is a Rorschach test, revealing whatever the interpreter wants to see. Nonfarm payrolls jumped by +119,000, trouncing expectations of +51,000. That's a headline that screams "strong economy!" But the unemployment rate also ticked up to 4.4%, a near four-year high. How can the labor market be both strong and weak at the same time?

Weekly continuing claims rose to 1.974 million, the most in four years. A rising unemployment rate with rising continuing claims suggest that people are having a harder time finding work. The Fed’s rate-cut calculus is now even more complicated (if it wasn't already). The CME FedWatch Tool shows the chance of a rate cut at the December FOMC meeting rose to 39.6% today from 30.1% on Wednesday, but the odds have declined sharply from 50% a week ago and 98.8% a month ago. It’s a mess of conflicting signals.

Earnings Illusions and Market Sentiment

The Q3 earnings season is wrapping up, and the numbers look rosy on the surface. Bloomberg Intelligence reports that 82% of S&P 500 companies exceeded forecasts, and Q3 earnings rose +14.6%, more than doubling expectations of +7.2% y/y. But these numbers don't tell the whole story.

What were those forecasts before companies started reporting? Were expectations deliberately lowered to make the actual results look better? This is the part of the report that I find genuinely puzzling. It's not about lying, but about managing expectations. A company beats a lowered bar, the stock pops, and everyone celebrates. But has anything fundamentally changed?

Walmart's +5% jump after boosting its 2026 net sales forecast is a good example. The increase was from +3.75% to 4.75% to +4.8% to +5.1%. That’s a fraction of a percent, but enough to excite investors.

The VIX: A Hedge Fund Thermometer

The VIX isn't just a number; it's a collective assessment of risk, a real-time poll of hedge fund managers and institutional investors. When the VIX spikes, it means the smart money is buying protection, hedging their bets, and preparing for volatility. It’s like a financial early warning system.

The VIX's current level suggests that the market's faith in the "soft landing" narrative is wavering. The initial euphoria over Nvidia's earnings was a sugar rush, a temporary distraction from the fundamental uncertainties that continue to plague the market.

The analyst community is downgrading the Volatility Index (VXX), stating that investors are on edge heading into the holidays. Historical data reveal that forward S&P 500 returns tend to be weakest in the mid-20s VIX range.

So, What's the Real Story?

The market’s initial cheerleading for NVDA was a head fake. The VIX spike is the real story, a flashing warning sign that smart money is bracing for impact.

Related Articles

IRS Direct Deposit Stimulus: The Truth About the October 2025 Payment

That $2,000 IRS Stimulus Check? It's Not Real, But The Rumor Itself Is Telling Let’s be clear, becau...

Xiaomi's 2026 Price Hike: What's Happening with Xiaomi 17 and the Phone Wars?

[Generated Title]: Xiaomi's 2026 Price Hike Warning: Translation—"Get Ready to Bend Over, Suckers" S...

American Battery's Breakthrough: Why It's Surging and What It Means for the Future of Energy

The Quiet Roar of the Energy Transition Just Became Deafening When I saw the news flash across my sc...

Broadcom's OpenAI Sugar Rush: Why I'm Not Buying a Single Share

Another Monday, another multi-billion dollar AI deal that we're all supposed to applaud like trained...

Gold Price Analysis: Today's Price, Key Metrics, and the Silver Correlation

Gold's Dizzying Climb to $4,000: A Sober Look at the Numbers Behind the Hype The numbers flashing ac...

Beyond JNJ's Stock Price: The Breakthrough Science and Future Vision Everyone is Missing

It’s easy to get lost in the noise. On any given Monday, you can watch the digital ticker tape scrol...