Morningstar: What is it, Lucifer, and Charlie Morningstar?

Alright, let's get real. "High-yield bond funds." Sounds fancy, right? Like some kind of sophisticated investment strategy for dudes in suspenders and slicked-back hair. But let's call it what it is: gambling with debt. You're betting on companies that are one missed payment away from going belly up.

The Usual Suspects

Morningstar, bless their little rating agency hearts, has put out a list of "top performers." 5 Top-Performing High Yield Bond Funds Artisan, BlackRock, Fidelity, Franklin Templeton... the usual suspects. The big boys. They're all patting themselves on the back for outperforming the "average" high-yield fund. Which, let's be honest, is like winning a race against a bunch of toddlers.

What does "high-yield" even mean? Oh, right, it means they're peddling junk bonds. Bonds so risky that the only way they can get anyone to buy them is to offer a juicy interest rate. It's like dangling a donut in front of a diabetic. Tempting, sure, but probably not a great idea long-term.

Fidelity gets two spots on the list. Two! Max Curtin, some "analyst" over there, says their "research engines" are the key to their success. Research engines? Is that what they're calling the guys who spend all day sifting through financial statements looking for the least-smelly turd in the pile?

The Fine Print (and the BS)

Here's the kicker: "Because the screen was created with the lowest-cost share class for each fund, some may be listed with share classes that are not accessible to individual investors outside of retirement plans..." Oh, offcourse, the good stuff is only for the big boys. The little guy gets stuck with the high-fee version that eats away at any potential gains. It's the Wall Street way.

Artisan High Income Fund closed to new investors back in 2021. Closed! Brian Moriarty calls it "an important step in protecting the integrity of Krug’s investment approach." Translation: "We got too big, and now we can't make the same returns, so we're shutting the door before you all figure it out." But hey, at least his "institutional share class" beat half its peers most years. Big deal.

BlackRock’s "flexible approach" involves dabbling in ETFs, credit default swaps, and even equities. Equities! So, they're not just betting on junk bonds, they're throwing in some stocks for good measure. Jeana Doubell calls it "nimble." I call it reckless. Like a dude juggling chainsaws while riding a unicycle.

Franklin Templeton’s claim to fame? They acquired Putnam and now have more credit analysts. More analysts to tell them that these bonds are probably gonna default eventually? Great.

So, Where's the Upside?

Look, I get it. Interest rates are still kinda high, and people are desperate for yield. But chasing high-yield bonds is like chasing a mirage in the desert. You might get a temporary thrill, but you're probably gonna end up dehydrated and broke.

And let's not forget that these funds are actively managed. That means you're paying someone a hefty fee to pick the "best" junk bonds. But are they really that good at it? Or are they just getting lucky and charging you for the privilege? I dunno... makes you think.

This Whole Thing Stinks

These "top-performing" high-yield bond funds are just different shades of garbage. They're all risky, they're all expensive, and they're all being peddled by Wall Street types who are making a killing off your desperation. Buyer beware.

Related Articles

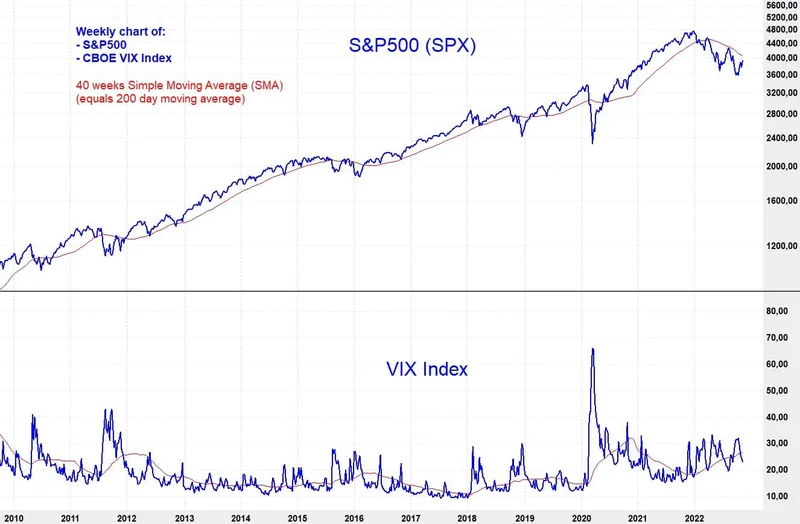

VIX Spikes as Nvidia Rally Fades: What's Driving Volatility and Market Fears

Nvidia's Mirage: The VIX Whispers a Different Story Nvidia's earnings were supposed to be the shot i...

Fifth Third Swallows Comerica for $10.9B: Why It's Happening and Why You Should Care

So, another Monday, another multi-billion dollar deal that promises to "create value" and "drive syn...

Allegiant Airlines Passenger Growth: What the 12.6% Surge Actually Means

More Passengers, Less Full Planes: Deconstructing Allegiant's Growth Paradox At first glance, news t...

uber stock: price today and earnings – What Reddit is Saying

[Generated Title]: Uber's Stock Plunge: Should You Bail, Buy, or Just Laugh? Alright, alright, settl...

Plug Stock's Big Jump: What's Actually Happening and Why You Shouldn't Buy the Hype

So, Plug Power is back. Just when you thought the stock was destined to become a footnote in the ann...

RGTI Stock: A Comparative Analysis vs. IONQ and NVDA

The market action surrounding Rigetti Computing (RGTI) in 2025 presents a fascinating case study in...